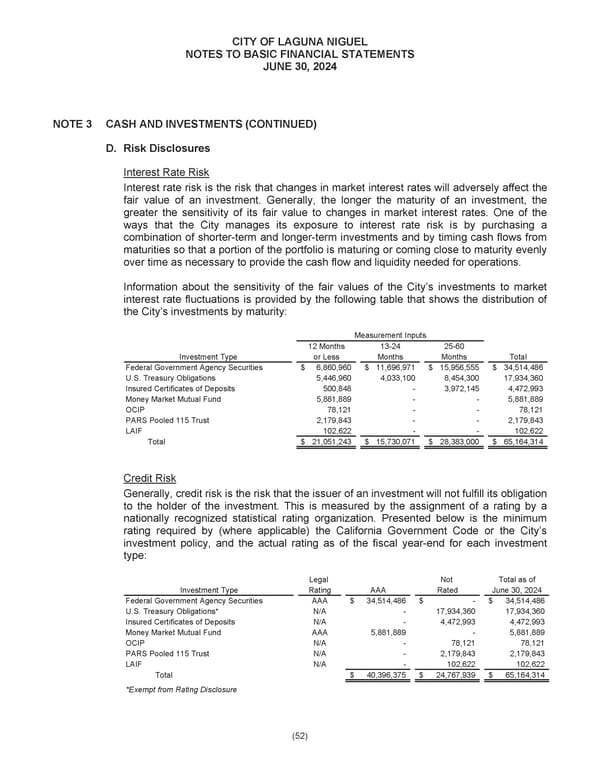

CITY OF LAGUNA NIGUEL NOTES TO BASIC FINANCIAL STATEMENTS JUNE 30, 2024 NOTE 3 CASH AND INVESTMENTS (CONTINUED) D. Risk Disclosures Interest Rate Risk Interest rate risk is the risk that changes in market interest rates will adversely affect the fair value of an investment. Generally, the longer the maturity of an investment, the greater the sensitivity of its fair value to changes in market interest rates. One of the ways that the City manages its exposure to interest rate risk is by purchasing a combination of shorter-term and longer-term investments and by timing cash flows from maturities so that a portion of the portfolio is maturing or coming close to maturity evenly over time as necessary to provide the cash flow and liquidity needed for operations. Information about the sensitivity of the fair values of the City’s investments to market interest rate fluctuations is provided by the following table that shows the distribution of the City’s investments by maturity: Measurement Inputs 12 Months 13-24 25-60 Investment Type or Less Months Months Total Federal Government Agency Securities $ 6,860,960 $ 11,696,971 $ 15,956,555 $ 34,514,486 U.S. Treasury Obligations 5,446,960 4,033,100 8,454,300 17,934,360 Insured Certificates of Deposits 500,848 - 3,972,145 4,472,993 Money Market Mutual Fund 5,881,889 - - 5,881,889 OCIP 78,121 - - 78,121 PARS Pooled 115 Trust 2,179,843 - - 2,179,843 LAIF 102,622 - - 102,622 Total $ 21,051,243 $ 15,730,071 $ 28,383,000 $ 65,164,314 Credit Risk Generally, credit risk is the risk that the issuer of an investment will not fulfill its obligation to the holder of the investment. This is measured by the assignment of a rating by a nationally recognized statistical rating organization. Presented below is the minimum rating required by (where applicable) the California Government Code or the City’s investment policy, and the actual rating as of the fiscal year-end for each investment type: Legal Not Total as of Investment Type Rating AAA Rated June 30, 2024 Federal Government Agency Securities AAA $ 34,514,486 $ - $ 34,514,486 U.S. Treasury Obligations* N/A - 17,934,360 17,934,360 Insured Certificates of Deposits N/A - 4,472,993 4,472,993 Money Market Mutual Fund AAA 5,881,889 - 5,881,889 OCIP N/A - 78,121 78,121 PARS Pooled 115 Trust N/A - 2,179,843 2,179,843 LAIF N/A - 102,622 102,622 Total $ 40,396,375 $ 24,767,939 $ 65,164,314 *Exempt from Rating Disclosure (52)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 73 Page 75

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 73 Page 75