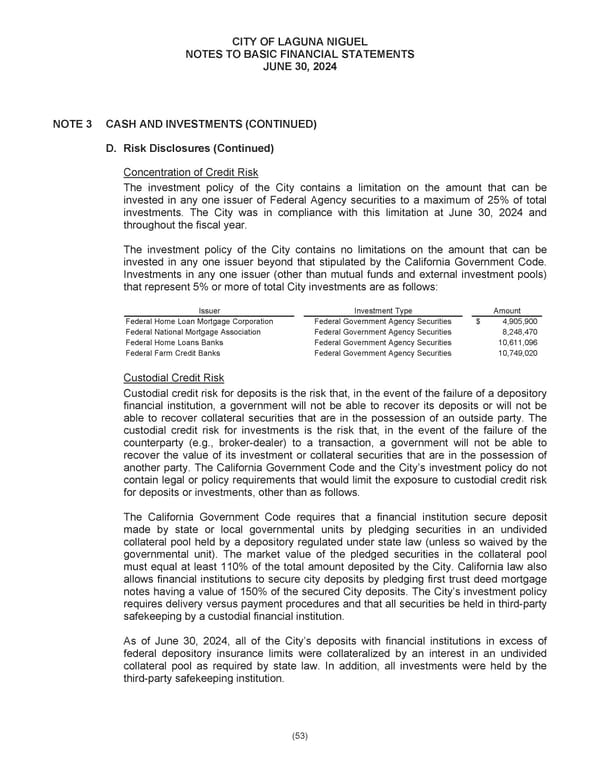

CITY OF LAGUNA NIGUEL NOTES TO BASIC FINANCIAL STATEMENTS JUNE 30, 2024 NOTE 3 CASH AND INVESTMENTS (CONTINUED) D. Risk Disclosures (Continued) Concentration of Credit Risk The investment policy of the City contains a limitation on the amount that can be invested in any one issuer of Federal Agency securities to a maximum of 25% of total investments. The City was in compliance with this limitation at June 30, 2024 and throughout the fiscal year. ment policy of the City contains no limitations on the amount that can be The invest invested in any one issuer beyond that stipulated by the California Government Code. Investments in any one issuer (other than mutual funds and external investment pools) that represe nt 5% or more of total City investments are as follows: Issuer Investment Type Amount Federal Home Loan Mortgage Corporation Federal Government Agency Securities $ 4,905,900 Federal National Mortgage Association Federal Government Agency Securities 8, 248,470 Federal Home Loans Banks Federal Government Agency Securities 10,611,096 Federal Farm Credit Banks Federal Government Agency Securities 10,749,020 Custodial Credit Risk Custodial credit risk for deposits is the risk that, in the event of the failure of a depository financial institution, a government will not be able to recover its deposits or will not be able to recover collateral securities that are in the possession of an outside party. The custodial credit risk for investments is the risk that, in the event of the failure of the counterparty (e.g., broker-dealer) to a transaction, a government will not be able to recover the value of its investment or collateral securities that are in the possession of another party. The California Government Code and the City’s investment policy do not contain legal or policy requirements that would limit the exposure to custodial credit risk for deposits or investments, other than as follows. The California Government Code requires that a financial institution secure deposit made by state or local governmental units by pledging securities in an undivided collateral pool held by a depository regulated under state law (unless so waived by the governmental unit). The market value of the pledged securities in the collateral pool must equal at least 110% of the total amount deposited by the City. California law also allows financial institutions to secure city deposits by pledging first trust deed mortgage notes having a value of 150% of the secured City deposits. The City’s investment policy requires delivery versus payment procedures and that all securities be held in third-party safekeeping by a custodial financial institution. As of June 30, 2024, all of the City’s deposits with financial institutions in excess of federal depository insurance limits were collateralized by an interest in an undivided collateral pool as required by state law. In addition, all investments were held by the third-party safekeeping institution. (53)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 74 Page 76

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 74 Page 76