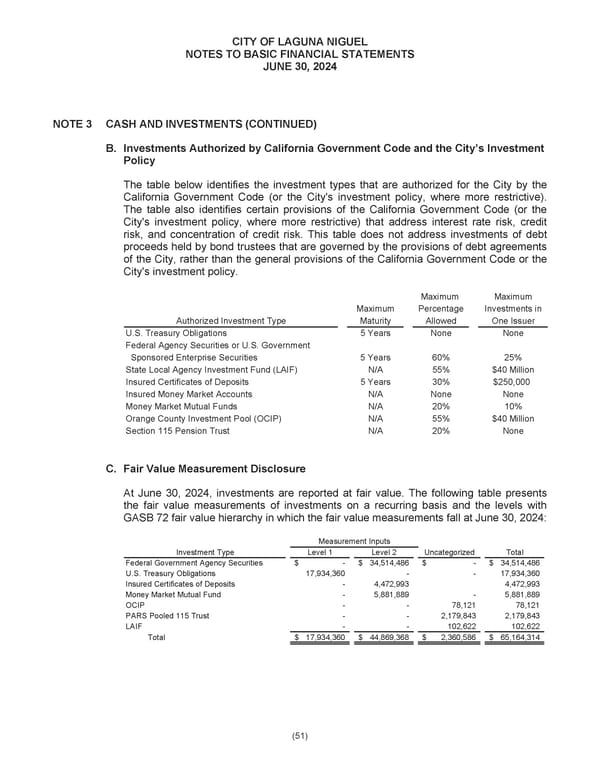

CITY OF LAGUNA NIGUEL NOTES TO BASIC FINANCIAL STATEMENTS JUNE 30, 2024 NOTE 3 CASH AND INVESTMENTS (CONTINUED) B. Investments Authorized by California Government Code and the City’s Investment Policy elow identifies the investment types that are authorized for the City by the The table b California Government Code (or the City's investment policy, where more restrictive). The table also identifies certain provisions of the California Government Code (or the City's investment policy, where more restrictive) that address interest rate risk, credit risk, and concentration of credit risk. This table does not address investments of debt proceeds he ld by bond trustees that are governed by the provisions of debt agreements nia Government Code or the of the City, rather than the general provisions of the Califor City's inve stment policy. Maximum Maximum Maximum Percentage Investments in Authorized Investment Type Maturity Allowed One Issuer U.S. Treasury Obligations 5 Years None None Federal Agency Securities or U.S. Government Sponsored Enterprise Securities 5 Years 60% 25% State Local Agency Investment Fund (LAIF) N/A 55% $40 Million Insured Certificates of Deposits 5 Years 30% $250,000 Insured Money Market Accounts N/A None None Money Market Mutual Funds N/A 20% 10% Orange County Investment Pool (OCIP) N/A 55% $40 Million Section 115 Pension Trust N/A 20% None C. Fair Value Measurement Disclosure At June 30, 2024, investments are reported at fair value. The following table presents e measurements of investments on a recurring basis and the levels with the fair valu GASB 72 fair value hierarchy in which the fair value measurements fall at June 30, 2024: Measurement Inputs Investment Type Level 1 Level 2 Uncategorized Total Federal Government Agency Securities $ - $ 34,514,486 $ - $ 34,514,486 U.S. Treasury Obligations 17,934,360 - - 17,934,360 Insured Certificates of Deposits - 4,472,993 4,472,993 Money Market Mutual Fund - 5,881,889 - 5,881,889 OCIP - - 78,121 78,121 PARS Pooled 115 Trust - - 2,179,843 2,179,843 LAIF - - 102,622 102,622 Total $ 17,934,360 $ 44,869,368 $ 2,360,586 $ 65,164,314 (51)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 72 Page 74

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 72 Page 74