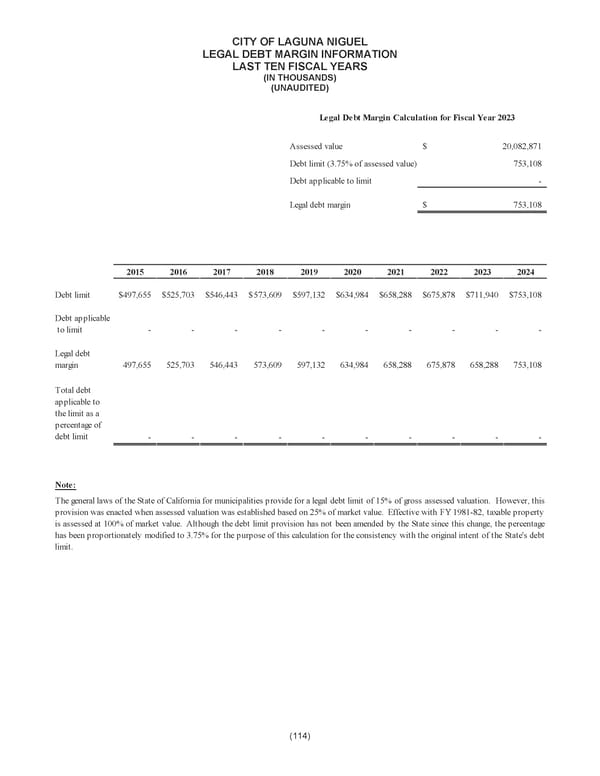

CITY OF LAGUNA NIGUEL LEGAL DEBT MARGIN INFORMATION LAST TEN FISCAL YEARS (IN THOUSANDS) (UNAUDITED) Legal Debt Margin Calculation for Fiscal Year 2023 Assessed value $ 20,082,871 Debt limit (3.75% of assessed value) 753,108 Debt applicable to limit - Legal debt margin $ 753,108 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Debt limit $ 52497,655 $ 5465,703 $ 57,443 $ 5973,609 $ 63,132 $ 654,984 $ 68,288 $ 7175,878 $ 7531,940 $ ,108 Debt applicable to limit - - - - - - - - - - Legal debt margin 497,655 525,703 546 ,443 573,609 597 ,132 634,984 65 8,288 675,878 658,288 753 ,108 Total debt applicable to the limit as a percentage of debt limit - - - - - - - - - - Note: Thegeneral laws of the State of California for municipalities provide for a legal debt limit of 15% of gross assessed valuation. However, this provision was enacted when assessed valuation was established based on 25% of market value. Effective with FY1981-82, taxable property is assessed at 100% of market value. Although the debt limit provision has not been amended by the State since this change, the percentage has been proportionately modified to 3.75% for the purpose of this calculation for the consistency with the original intent of the State's debt limit. (114)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 135 Page 137

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 135 Page 137