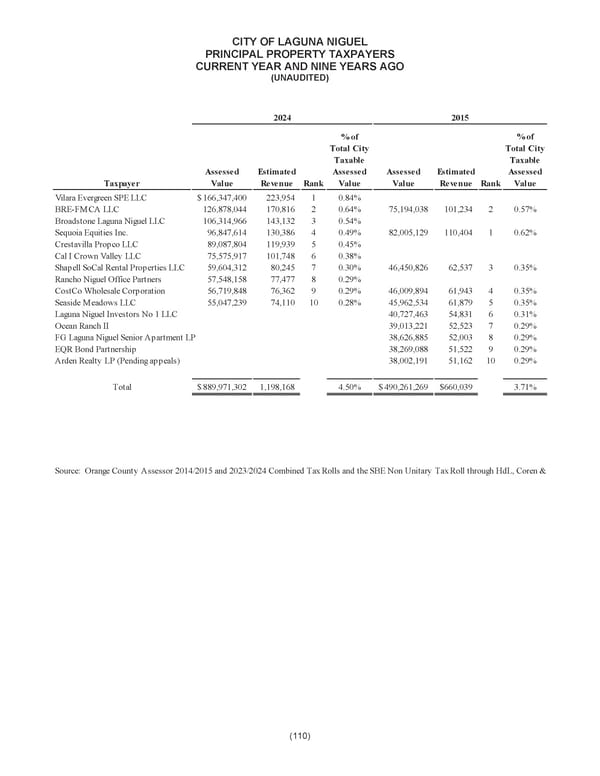

CITY OF LAGUNA NIGUEL PRINCIPAL PROPERTY TAXPAYERS CURRENT YEAR AND NINE YEARS AGO (UNAUDITED) 2024 2015 % of % of Total City Total City Taxable Taxable Assessed Estimated Assessed Assessed Estimated Assessed Taxpayer Value Revenue Rank Value Value Revenue Rank Value Vilara Evergreen SPE LLC $ 2166,347,400 23,954 1 0.84% BRE-FMCA LLC 126,878,044 170,816 2 0.64% 75,194,038 101,234 2 0.57% Broadstone Laguna Niguel LLC 106,314,966 143,132 3 0.54% Sequoia Equities Inc. 96,847,614 130,386 4 0.49% 82,005,129 110, 404 1 0.62% Crestavilla Propco LLC 89,087,804 119,939 5 0.45% Cal I Crown Valley LLC 75,575,917 101,748 6 0.38% Shapell SoCal Rental Properties LLC 59,604,312 80,245 7 0.30% 46,450,826 62,537 3 0.35% Rancho Niguel Office Partners 57,548,158 77,477 8 0.29% CostCo Wholesale Corporation 56,719,848 76,362 9 0.29% 46,009,894 61,943 4 0.35% Seaside Meadows LLC 55,047,239 74,110 10 0.28% 45,962,534 61,879 5 0.35% Laguna Niguel Investors No 1 LLC 40,727,463 54,831 6 0.31% Ocean Ranch II 39,013,221 52,523 7 0.29% FG Laguna Niguel Senior Apartment LP 38,626,885 52,003 8 0.29% EQR Bond Partnership 38,269,088 51,522 9 0.29% Arden Realty LP (Pending appeals) 38,002,191 51,162 10 0.29% Total $ 1,1889,971,302 4.98,168 50% $ 660,490,261,269 $ 3.71039 % Source: Orange County Assessor 2014/2015 and 2023/2024 Combined Tax Rolls and the SBE Non Unitary Tax Roll through HdL, Coren & (110)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 131 Page 133

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 131 Page 133