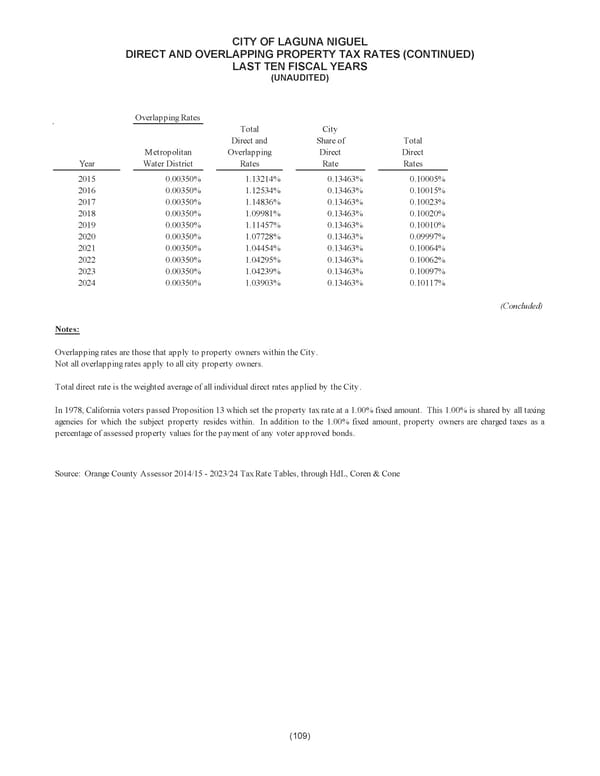

CITY OF LAGUNA NIGUEL DIRECT AND OVERLAPPING PROPERTY TAX RATES (CONTINUED) LAST TEN FISCAL YEARS (UNAUDITED) Overlapping Rates Total City Direct and Share of Total Metropolitan Overlapping Direct Direct Year Water District Rates Rate Rates 2015 0.00350% 1.13214% 0.13463% 0.10005% 2016 0.00350% 1.12534% 0.13463% 0.10015% 2017 0.00350% 1.14836% 0.13463% 0.10023% 2018 0.00350% 1.09981% 0.13463% 0.10020% 2019 0.00350% 1.11457% 0.13463% 0.10010% 2020 0.00350% 1.07728% 0.13463% 0.09997% 2021 0.00350% 1.04454% 0.13463% 0.10064% 2022 0.00350% 1.04295% 0.13463% 0.10062% 2023 0.00350% 1.04239% 0.13463% 0.10097% 2024 0.00350% 1.03903% 0.13463% 0.10117% (Concluded) Notes: Overlapping rates are those that apply to property owners within the City. Not all overlapping rates apply to all city property owners. Total direct rate is the weighted average of all individual direct rates applied by the City. In 1978, California voters passed Proposition 13 which set the property taxrate at a 1.00% fixed amount. This 1.00% is shared by all taxing agencies for which the subject property resides within. In addition to the 1.00% fixed amount, property owners are charged taxes as a percentage of assessed property values for the payment of any voter approved bonds. Source: Orange County Assessor 2014/15 - 2023/24 Tax Rate Tables, through HdL, Coren & Cone (109)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 130 Page 132

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 130 Page 132