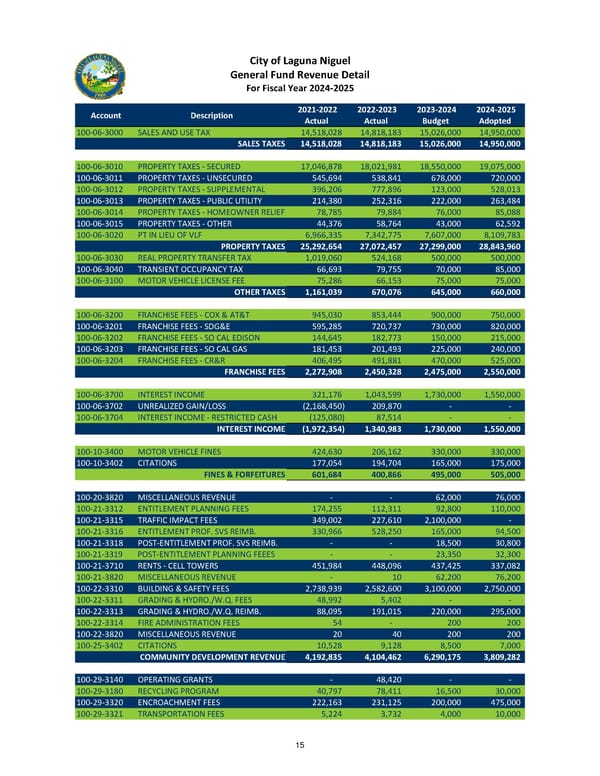

City of Laguna Niguel General Fund Revenue Detail For Fiscal Year 2024‐2025 2021‐2022 2022‐2023 2023‐2024 2024‐2025 Account Description Actual Actual Budget Adopted 100‐06‐3000 SALES AND USE TAX 14,518,028 14,818,183 15,026,000 14,950,000 SALES TAXES 14,518,028 14,818,183 15,026,000 14,950,000 100‐06‐3010 PROPERTY TAXES ‐ SECURED 17,046,878 18,021,981 18,550,000 19,075,000 100‐06‐3011 PROPERTY TAXES ‐ UNSECURED 545,694 538,841 678,000 720,000 100‐06‐3012 PROPERTY TAXES ‐ SUPPLEMENTAL 396,206 777,896 123,000 528,013 100‐06‐3013 PROPERTY TAXES ‐ PUBLIC UTILITY 214,380 252,316 222,000 263,484 100‐06‐3014 PROPERTY TAXES ‐ HOMEOWNER RELIEF 78,785 79,884 76,000 85,088 100‐06‐3015 PROPERTY TAXES ‐ OTHER 44,376 58,764 43,000 62,592 100‐06‐3020 PT IN LIEU OF VLF 6,966,335 7,342,775 7,607,000 8,109,783 PROPERTY TAXES 25,292,654 27,072,457 27,299,000 28,843,960 100‐06‐3030 REAL PROPERTY TRANSFER TAX 1,019,060 524,168 500,000 500,000 100‐06‐3040 TRANSIENT OCCUPANCY TAX 66,693 79,755 70,000 85,000 100‐06‐3100 MOTOR VEHICLE LICENSE FEE 75,286 66,153 75,000 75,000 OTHER TAXES 1,161,039 670,076 645,000 660,000 100‐ 06‐3200 FRANCHISE FEES ‐ COX & AT&T 945,030 853,444 900,000 750,000 100‐06‐3201 FRANCHISE FEES ‐ SDG&E 595,285 720,737 730,000 820,000 100‐06‐3202 FRANCHISE FEES ‐ SO CAL EDISON 144,645 182,773 150,000 215,000 100‐06‐3203 FRANCHISE FEES ‐ SO CAL GAS 181,453 201,493 225,000 240,000 100‐06‐3204 FRANCHISE FEES ‐ CR&R 406,495 491,881 470,000 525,000 FRANCHISE FEES 2,272,908 2,450,328 2,475,000 2,550,000 100‐06‐3700 INTEREST INCOME 321,176 1,043,599 1,730,000 1,550,000 100‐06‐3702 UNREALIZED GAIN/LOSS (2,168,450) 209,870 ‐ ‐ 100‐06‐3704 INTEREST INCOME ‐ RESTRICTED CASH (125,080) 87,514 ‐ ‐ INTEREST INCOME (1,972,354) 1,340,983 1,730,000 1,550,000 100‐10‐3400 MOTOR VEHICLE FINES 424,630 206,162 330,000 330,000 100‐10‐3402 CITATIONS 177,054 194,704 165,000 175,000 FINES & FORFEITURES 601,684 400,866 495,000 505,000 100‐20‐3820 MISCELLANEOUS REVENUE ‐ ‐ 62,000 76,000 100‐21‐3312 ENTITLEMENT PLANNING FEES 174,255 112,311 92,800 110,000 100‐21‐3315 TRAFFIC IMPACT FEES 349,002 227,610 2,100,000 ‐ 100‐21‐3316 ENTITLEMENT PROF. SVS REIMB. 330,966 528,250 165,000 94,500 100‐21‐3318 POST‐ENTITLEMENT PROF. SVS REIMB. ‐ ‐ 18,500 30,800 100‐21‐3319 POST‐ENTITLEMENT PLANNING FEEES ‐ ‐ 23,350 32,300 100‐21‐3710 RENTS ‐ CELL TOWERS 451,984 448,096 437,425 337,082 100‐21‐3820 MISCELLANEOUS REVENUE ‐ 10 62,200 76,200 100‐22‐3310 BUILDING & SAFETY FEES 2,738,939 2,582,600 3,100,000 2,750,000 100‐22‐3311 GRADING & HYDRO./W.Q. FEES 48,992 5,402 ‐ ‐ 100‐22‐3313 GRADING & HYDRO./W.Q. REIMB. 88,095 191,015 220,000 295,000 100‐22‐3314 FIRE ADMINISTRATION FEES 54 ‐ 200 200 100‐22‐3820 MISCELLANEOUS REVENUE 20 40 200 200 100‐25‐3402 CITATIONS 10,528 9,128 8,500 7,000 COMMUNITY DEVELOPMENT REVENUE 4,192,835 4,104,462 6,290,175 3,809,282 100‐29‐3140 OPERATING GRANTS ‐ 48,420 ‐ ‐ 100‐29‐3180 RECYCLING PROGRAM 40,797 78,411 16,500 30,000 100‐ 29‐3320 ENCROACHMENT FEES 222,163 231,125 200,000 475,000 100‐29‐3321 TRANSPORTATION FEES 5,224 3,732 4,000 10,000 15

FY 2024-25 Adopted Operating Budget and Capital Improvement Program Page 29 Page 31

FY 2024-25 Adopted Operating Budget and Capital Improvement Program Page 29 Page 31