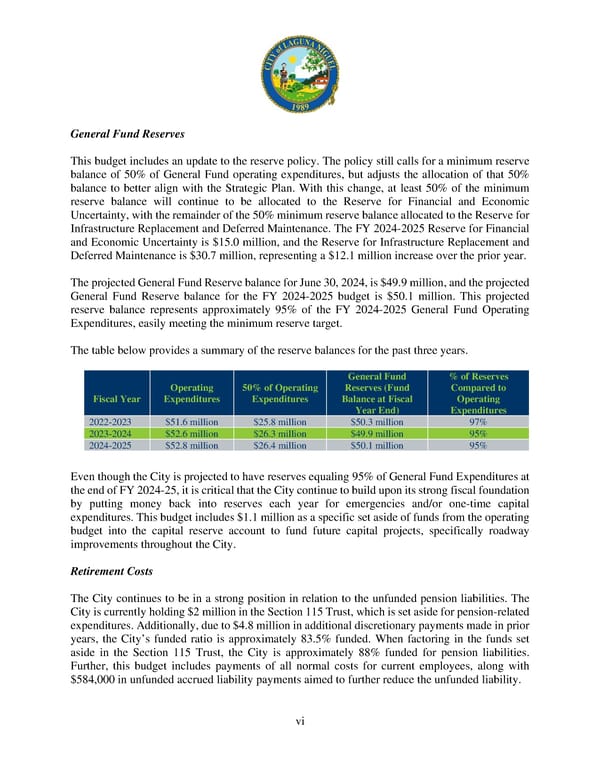

General Fund Reserves This budget includes an update to the reserve policy. The policy still calls for a minimum reserve balance of 50% of General Fund operating expenditures, but adjusts the allocation of that 50% balance to better align with the Strategic Plan. With this change, at least 50% of the minimum reserve balance will continue to be allocated to the Reserve for Financial and Economic Uncertainty, with the remainder of the 50% minimum reserve balance allocated to the Reserve for Infrastructure Replacement and Deferred Maintenance. The FY 2024-2025 Reserve for Financial and Economic Uncertainty is $15.0 million, and the Reserve for Infrastructure Replacement and Deferred Maintenance is $30.7 million, representing a $12.1 million increase over the prior year. The projected General Fund Reserve balance for June 30, 2024, is $49.9 million, and the projected General Fund Reserve balance for the FY 2024-2025 budget is $50.1 million. This projected reserve balance represents approximately 95% of the FY 2024-2025 General Fund Operating Expenditures, easily meeting the minimum reserve target. The table below provides a summary of the reserve balances for the past three years. General Fund % of Reserves Operating 50% of Operating Reserves (Fund Compared to Fiscal Year Expenditures Expenditures Balance at Fiscal Operating Year End) Expenditures 2022-2023 $51.6 million $25.8 million $50.3 million 97% 2023-2024 $52.6 million $26.3 million $49.9 million 95% 2024-2025 $52.8 million $26.4 million $50.1 million 95% Even though the City is projected to have reserves equaling 95% of General Fund Expenditures at the end of FY 2024-25, it is critical that the City continue to build upon its strong fiscal foundation by putting money back into reserves each year for emergencies and/or one-time capital expenditures. This budget includes $1.1 million as a specific set aside of funds from the operating budget into the capital reserve account to fund future capital projects, specifically roadway improvements throughout the City. Retirement Costs The City continues to be in a strong position in relation to the unfunded pension liabilities. The City is currently holding $2 million in the Section 115 Trust, which is set aside for pension-related expenditures. Additionally, due to $4.8 million in additional discretionary payments made in prior years, the City’s funded ratio is approximately 83.5% funded. When factoring in the funds set aside in the Section 115 Trust, the City is approximately 88% funded for pension liabilities. Further, this budget includes payments of all normal costs for current employees, along with $584,000 in unfunded accrued liability payments aimed to further reduce the unfunded liability. vi

FY 2024-25 Adopted Operating Budget and Capital Improvement Program Page 12 Page 14

FY 2024-25 Adopted Operating Budget and Capital Improvement Program Page 12 Page 14