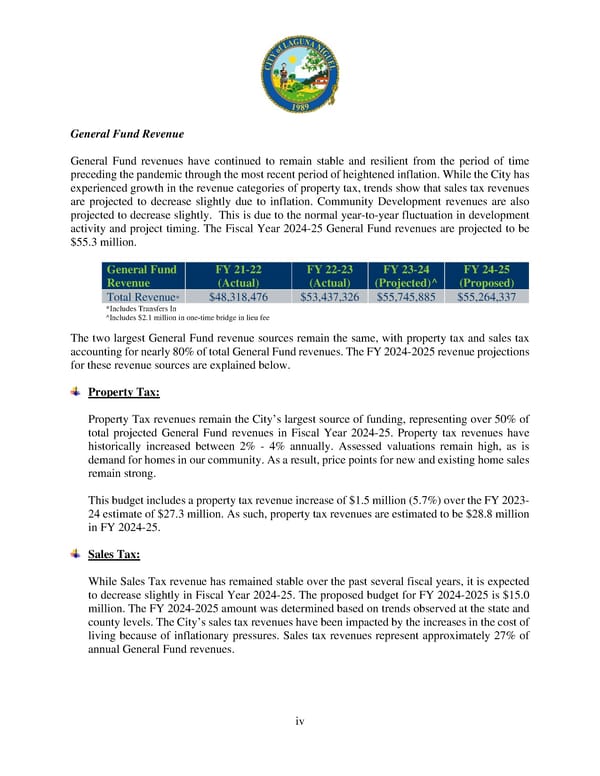

General Fund Revenue General Fund revenues have continued to remain stable and resilient from the period of time preceding the pandemic through the most recent period of heightened inflation. While the City has experienced growth in the revenue categories of property tax, trends show that sales tax revenues are projected to decrease slightly due to inflation. Community Development revenues are also projected to decrease slightly. This is due to the normal year-to-year fluctuation in development activity and project timing. The Fiscal Year 2024-25 General Fund revenues are projected to be $55.3 million. General Fund FY 21-22 FY 22-23 FY 23-24 FY 24-25 Revenue (Actual) (Actual) (Projected)^ (Proposed) Total Revenue* $48,318,476 $53,437,326 $55,745,885 $55,264,337 *Includes Transfers In ^Includes $2.1 million in one-time bridge in lieu fee The two largest General Fund revenue sources remain the same, with property tax and sales tax accounting for nearly 80% of total General Fund revenues. The FY 2024-2025 revenue projections for these revenue sources are explained below. Property Tax: Property Tax revenues remain the City’s largest source of funding, representing over 50% of total projected General Fund revenues in Fiscal Year 2024-25. Property tax revenues have historically increased between 2% - 4% annually. Assessed valuations remain high, as is demand for homes in our community. As a result, price points for new and existing home sales remain strong. This budget includes a property tax revenue increase of $1.5 million (5.7%) over the FY 2023- 24 estimate of $27.3 million. As such, property tax revenues are estimated to be $28.8 million in FY 2024-25. Sales Tax: While Sales Tax revenue has remained stable over the past several fiscal years, it is expected to decrease slightly in Fiscal Year 2024-25. The proposed budget for FY 2024-2025 is $15.0 million. The FY 2024-2025 amount was determined based on trends observed at the state and county levels. The City’s sales tax revenues have been impacted by the increases in the cost of living because of inflationary pressures. Sales tax revenues represent approximately 27% of annual General Fund revenues. iv

FY 2024-25 Adopted Operating Budget and Capital Improvement Program Page 10 Page 12

FY 2024-25 Adopted Operating Budget and Capital Improvement Program Page 10 Page 12