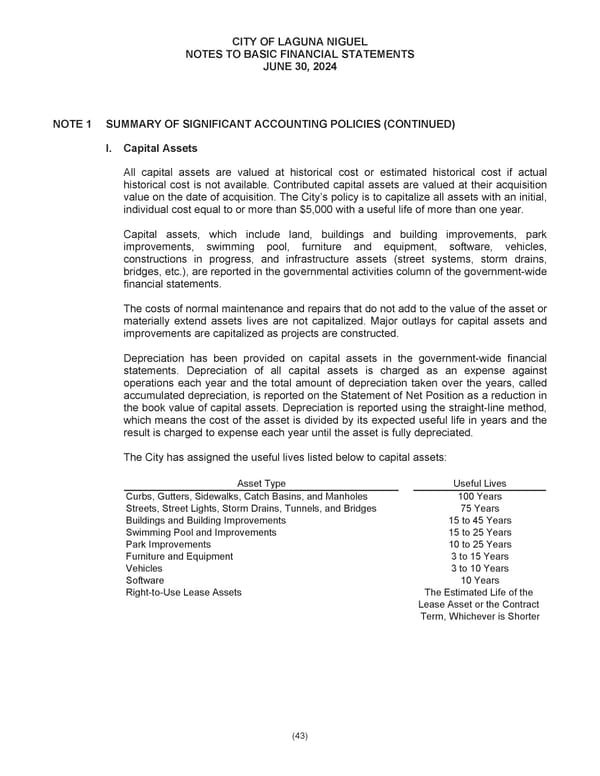

CITY OF LAGUNA NIGUEL NOTES TO BASIC FINANCIAL STATEMENTS JUNE 30, 2024 NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) I. Capital Assets al assets are valued at historical cost or estimated historical cost if actu All capit al l cost is not available. Contributed capital assets are valued at their acquisition historica value on the date of acquisition. The City’s policy is to capitalize all assets with an initial, individual cost equal to or more than $5,000 with a useful life of more than one year. Capital assets, which include land, buildings and building improvements, park improvements, swimming pool, furniture and equipment, software, vehicles, constructions in progress, and infrastructure assets (street systems, storm drains, bridges, etc. ), are reported in the governmental activities column of the government-wide ements. financial stat The costs of or normal maintenance and repairs that do not add to the value of the asset materially e xtend assets lives are not capitalized. Major outlays for capital assets and improvements are capitalized as projects are constructed. Depreciation has been provided on capital assets in the government-wide financial statements. Depreciation of all capital assets is charged as an expense against operations each year and the total amount of depreciation taken over the years, called accumulated depreciation, is reported on the Statement of Net Position as a reduction in the book value of capital assets. Depreciation is reported using the straight-line method, which means the cost of the asset is divided by its expected useful life in years and the charged to expense each year until the asset is fully depreciated. result is The City has assigned the useful lives listed below to capital assets: Asset Type Useful Lives Curbs, Gutters, Sidewalks, Catch Basins, and Manholes 100 Years Streets, Street Lights, Storm Drains, Tunnels, and Bridges 75 Years Buildings and Building Improvements 15 to 45 Years Swimming Pool and Improvements 15 to 25 Years Park Improvements 10 to 25 Years Furniture and Equipment 3 to 15 Years Vehicles 3 to 10 Years Software 10 Years Right-to-Use Lease Assets The Estimated Life of the Lease Asset or the Contract Term, Whichever is Shorte r (43)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 64 Page 66

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 64 Page 66