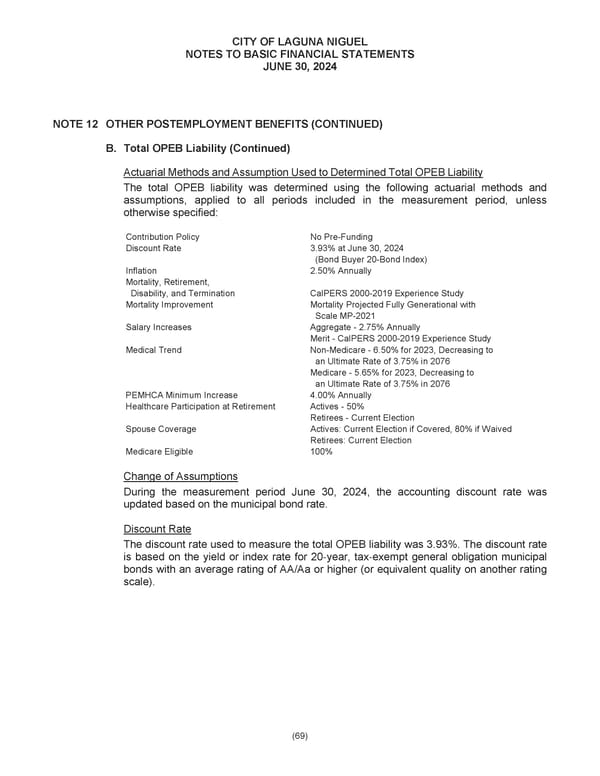

CITY OF LAGUNA NIGUEL NOTES TO BASIC FINANCIAL STATEMENTS JUNE 30, 2024 NOTE 12 OTHER POSTEMPLOYMENT BENEFITS (CONTINUED) B. Total OPEB Liability (Continued) Actuarial Methods and Assumption Used to Determined Total OPEB Liability The total OPEB liability was determined using the following actuarial methods and assumptions, applied to all periods included in the measurement period, unless otherwise specified: Contribution Policy No Pre-Funding Discount Rate 3.93% at June 30, 2024 (Bond Buyer 20-Bond Index) Inflation 2.50% Annually Mortality, Retirement, Disability, and Termination CalPERS 2000-2019 Experience Study Mortality Improvement Mortality Projected Fully Generational with Scale MP-2021 Salary Increases Aggregate - 2.75% Annually Merit - CalPERS 2000-2019 Experience Study Medical Trend Non-Medicare - 6.50% for 2023, Decreasing to an Ultimate Rate of 3.75% in 2076 Medicare - 5.65% for 2023, Decreasing to an Ultimate Rate of 3.75% in 2076 PEMHCA Minimum Increase 4.00% Annually Healthcare Participation at Retirement Actives - 50% Retirees - Current Election Spouse Coverage Actives: Current Election if Covered, 80% if Waived Retirees: Current Election Medicare Eligible 100% Change of Assumptions During the measurement period June 30, 2024, the accounting discount rate was updated based on the municipal bond rate. Discount Rate The discount rate used to measure the total OPEB liability was 3.93%. The discount rate is based on the yield or index rate for 20-year, tax-exempt general obligation municipal bonds with an average rating of AA/Aa or higher (or equivalent quality on another rating scale). (69)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 90 Page 92

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 90 Page 92