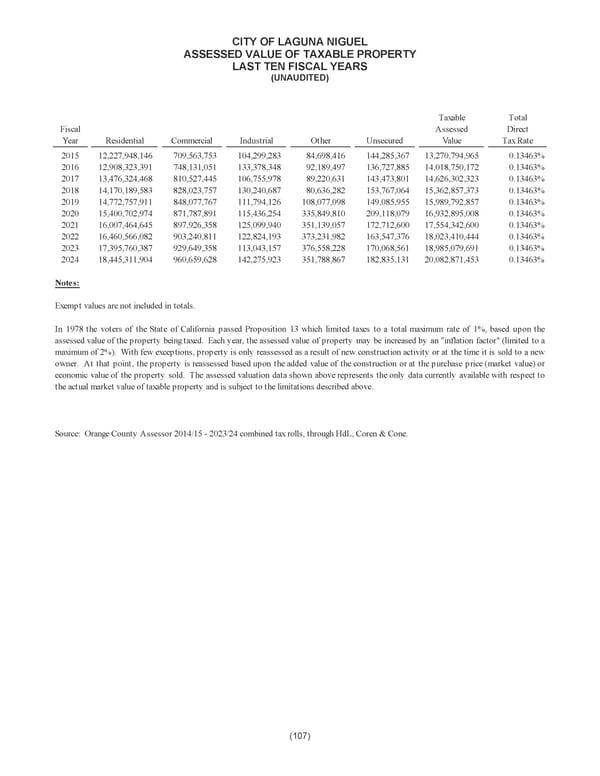

CITY OF LAGUNA NIGUEL ASSESSED VALUE OF TAXABLE PROPERTY LAST TEN FISCAL YEARS (UNAUDITED) Taxable Total Fiscal Assessed Direct Year Residential Commercial Industrial Other Unsecured Value Tax Rate 2015 12,227,948,146 709,563,753 104,299,283 84,698,416 144,285,367 013,270,794,965 .13463% 2016 12,908,323,391 748,131,051 133,378,348 92,189,497 136,727,885 014,018,750,172 .13463% 2017 13,476,324,468 810,527,445 106,755,978 89,220,631 143,473,801 014,626,302,323 .13463% 2018 14,170,189,583 828,023,757 130,240,687 80,636,282 153,767,064 015,362,857,373 .13463% 2019 14,772,757,911 848,077,767 111,794,126 108,077,098 149,085,955 015,989,792,857 .13463% 2020 15,400,702,974 871,787,891 115,436,254 335,849,810 209,118,079 016,932,895,008 .13463% 2021 16,007,464,645 897,926,358 125,099,940 351,139,057 172,712,600 017,554,342,600 .13463% 2022 16,460,566,082 903,240,811 122,824,193 373,231,982 163,547,376 018,023,410,444 .13463% 2023 17,395,760,387 929,649,358 113,043,157 376,558,228 170,068,561 018,985,079,691 .13463% 2024 18,445,311,904 960,659,628 142,275,923 351,788,867 182,835,131 020,082,871,453 .13463% Notes: Exempt values are not included in totals. In 1978 the voters of the State of California passed Proposition 13 which limited taxes to a total maximum rate of 1%, based upon the assessed value of the property beingtaxed. Each year, the assessed value of property may be increased by an "inflation factor" (limited to a maximumof 2%). With few exceptions, property is only reassessed as a result of new construction activity or at the time it is sold to a new owner. At that point, the property is reassessed based upon the added value of the construction or at the purchase price (market value) or economic value of the property sold. The assessed valuation data shown above represents the only data currently available with respect to the actual market value of taxable property and is subject to the limitations described above. Source: Orange County Assessor 2014/15 - 2023/24 combined tax rolls, through HdL, Coren & Cone. (107)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 128 Page 130

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 128 Page 130