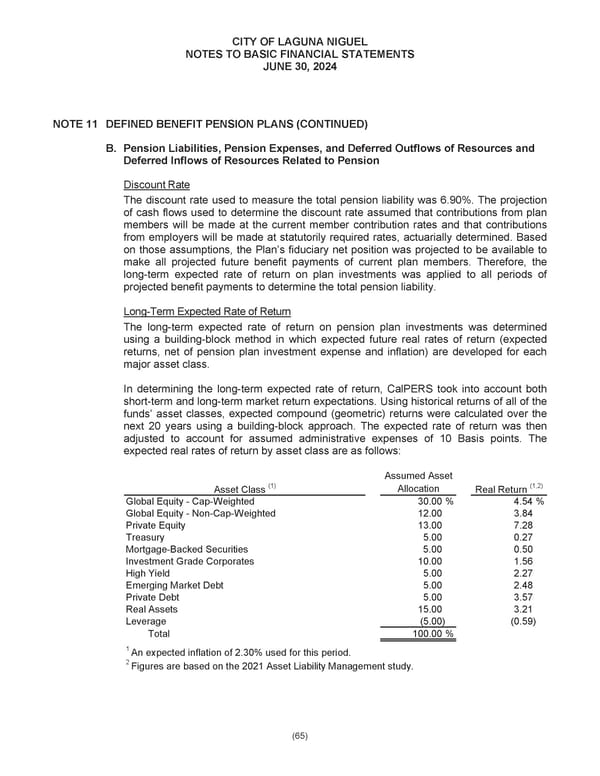

CITY OF LAGUNA NIGUEL NOTES TO BASIC FINANCIAL STATEMENTS JUNE 30, 2024 NOTE 11 DEFINED BENEFIT PENSION PLANS (CONTINUED) B. Pension Liabilities, Pension Expenses, and Deferred Outflows of Resources and Deferred Inflows of Resources Related to Pension ate Discount R The discount rate used to measure the total pension liability was 6.90%. The projection of cash flows used to determine the discount rate assumed that contributions from plan members will be made at the current member contribution rates and that contributions from employers will be made at statutorily required rates, actuarially determined. Based he Plan’s fiduciary net position was projected to be available to on those assumptions, t make all projected future benefit payments of current plan members. Therefore, the e of return on plan investments was applied to all periods of long-term expected rat projected benefit payments to determine the total pension liability. Long-Term Expected Rate of Return The long-term expected rate of return on pension plan investments was determined using a building-block method in which expected future real rates of return (expected returns, net of pension plan investment expense and inflation) are developed for each major asset class. In determining the long-term expected rate of return, CalPERS took into account both short-term and long-term market return expectations. Using historical returns of all of the classes, expected compound (geometric) returns were calculated over the funds’ asset next 20 years using a building-block approach. The expected rate of return was then account for assumed administrative expenses of 10 Basis points. adjusted to The expected real rates of return by asset class are as follows: Assumed Asset Asset Class (1) Allocation Real Return (1,2) Global Equity - Cap-Weighted 30.00 % 4.54 % Global Equity - Non-Cap-Weighted 12.00 3.84 Private Equity 13.00 7.28 Treasury 5.00 0.27 Mortgage-Backed Securities 5.00 0.50 Investment Grade Corporates 10.00 1.56 High Yield 5.00 2.27 Emerging Market Debt 5.00 2.48 Private Debt 5.00 3.57 Real Assets 15.00 3.21 Leverage (5.00) (0.59) Total 100.00 % 1 An expected inflation of 2.30% used for this period. 2 Figures are based on the 2021 Asset Liability Management study. (65)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 86 Page 88

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 86 Page 88