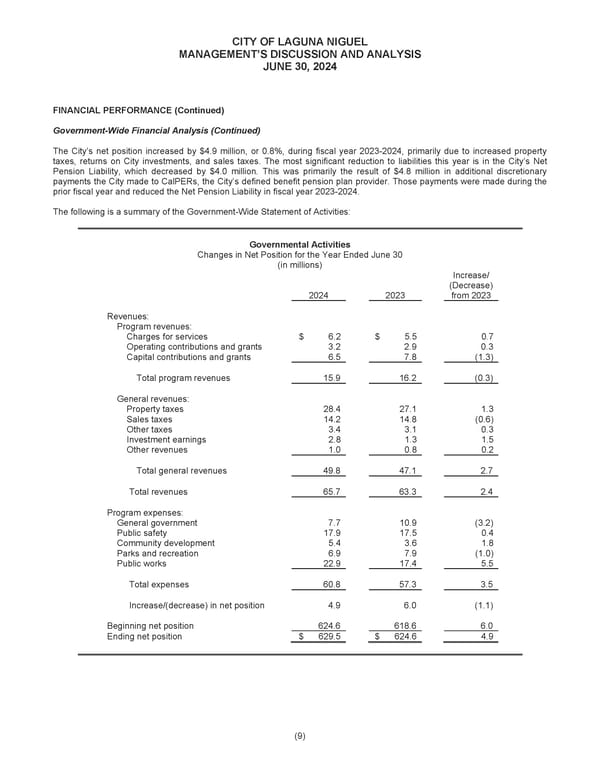

CITY OF LAGUNA NIGUEL MANAGEMENT’S DISCUSSION AND ANALYSIS JUNE 30, 2024 FINANCIAL PERFORMANCE (Continued) Government-Wide Financial Analysis (Continued) The City’s net position increased by $4.9 million, or 0.8%, during fiscal year 2023-2024, primarily due to increased property taxes, returns on City investments, and sales taxes. The most significant reduction to liabilities this year is in the City’s Net Pension Liability, which decreased by $4.0 million. This was primarily the result of $4.8 million in additional discretionary payments the City made to CalPERs, the City’s defined benefit pension plan provider. Those payments were made during the prior fiscal year and reduced the Net Pension Liability in fiscal year 2023-2024. The following is a summary of the Government-Wide Statement of Activities: Governmental Activities Changes in Net Position for the Year Ended June 30 (in millions) Increase/ (Decrease) 2024 2023 from 2023 Revenues: Program revenues: Charges for services $ 6.2 $ 5.5 0.7 Operating contributions and grants 3.2 2.9 0.3 Capital contributions and grants 6.5 7.8 (1.3) Total program revenues 15.9 16.2 (0.3) General revenues: Property taxes 28.4 27.1 1.3 Sales taxes 14.2 14.8 (0.6) Other taxes 3.4 3.1 0.3 Investment earnings 2.8 1.3 1.5 Other revenues 1.0 0.8 0.2 Total general revenues 49.8 47.1 2.7 Total revenues 65.7 63.3 2.4 Program expenses: General government 7.7 10.9 (3.2) Public safety 17.9 17.5 0.4 Community development 5.4 3.6 1.8 Parks and recreation 6.9 7.9 (1.0) Public works 22.9 17.4 5.5 Total expenses 60.8 57.3 3.5 Increase/(decrease) in net position 4.9 6.0 (1.1) Beginning net position 624.6 618.6 6.0 Ending net position $ 629.5 $ 624.6 4.9 (9)

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 30 Page 32

City of Laguna Niguel Annual Comprehensive Financial Report 2024 Page 30 Page 32